Zakat, one of the five pillars of Islam, is a powerful form of charity that plays a key role in creating a just and compassionate society. By giving Zakat, Muslims purify their wealth, gain rewards, and help uplift those in need. But what are the heads of Zakat?

What is Zakat?

Zakat is an obligatory act of charity for financially stable Muslims. Its roots lie in the Quran and Hadith, emphasizing the purification of wealth and helping others. This noble act doesn’t just benefit recipients; it brings spiritual blessings and purifies the giver’s possessions.

Quranic Basis

The Quran outlines Zakat’s importance clearly:

“The alms are only for the Fuqara’ (the poor), and Al-Masakin (the needy) and those employed to collect (the funds), and to attract the hearts of those who have been inclined (towards Islam), and to free the captives; and for those in debt; and for Allah’s Cause, and for the wayfarer (a traveler who is cut off from everything); a duty imposed by Allah. And Allah is All-Knower, All-Wise.” (Al-Quran 9:60)

“Take, [O Muhammad], from their wealth a charity by which you purify them and cause them to increase, and invoke [Allah’s blessings] upon them. Indeed, your invocations are reassurance for them. And Allah is Hearing and Knowing.” (Al-Quran 9:103)

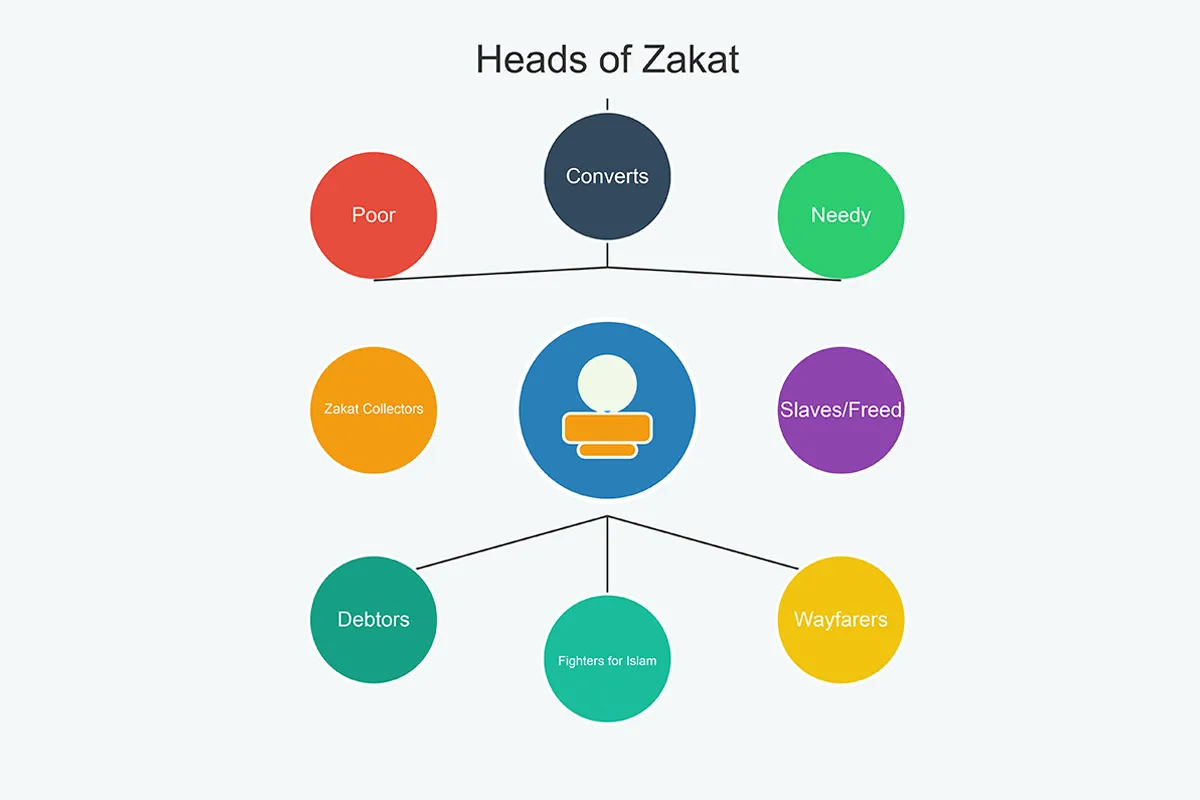

This verse lays the foundation for eight categories of Zakat recipients, known as the heads of Zakat.

Hadith on Zakat

The Prophet Muhammad (peace be upon him) said:

“Charity given to the poor is charity, and charity given to a relative is two things: charity and maintaining family ties.” (Sunan an-Nasa’i 2582)

He also emphasized:

“The upper hand is better than the lower hand. The upper hand is the one that gives, and the lower hand is the one that receives.” (Sahih al-Bukhari 1429)

Ultimate guide on what is zakat.

Who Are the Recipients of Zakat?

There are 8 types of Zakat recipients as mentioned in the Quran. Each category has its significance, ensuring Zakat reaches those who truly need it.

1. Al-Fuqara (The Poor)

The first category includes people living below the poverty line. These individuals struggle to meet basic needs such as food, clothing, and shelter. By directing your Zakat to Al-Fuqara, you help them improve their daily lives.

Quick Tip: Donate to trusted organizations that specialize in aiding the poor for maximum impact.

2. Al-Masakin (The Needy)

Unlike the poor, Al-Masakin are individuals who may have a stable income but still face significant hardships. These people might lack essential resources for a decent standard of living. Your Zakat helps alleviate their struggles.

The Prophet Muhammad (peace be upon him) said: “The best charity is to satisfy a hungry stomach.” (Sunan Ibn Majah 3664)

3. Zakat Collectors

The Quran permits Zakat funds to compensate those who collect and distribute these charitable contributions. These collectors, including NGOs and local committees, ensure Zakat reaches the right recipients efficiently.

“Those employed to collect (the funds)” are a part of the designated recipients, as per Quran 9:60.

4. New Converts to Islam

When individuals embrace Islam, they may face financial and emotional challenges, especially if abandoned by their families or communities. Zakat can provide them with support as they embark on their new spiritual journey.

Want to support new Muslims? Choose institutions dedicated to empowering them.

5. Freeing Captives

Even though slavery is largely eradicated, modern forms of enslavement like human trafficking persist. Zakat can be utilized to free individuals from such injustices, granting them dignity and a better future.

“…to free the captives…” (Al-Quran 9:60)

6. Debtors

People burdened by debt due to unforeseen circumstances are eligible for Zakat. It’s crucial, however, to ensure their financial troubles stem from legitimate and lawful reasons.

“Whoever relieves a believer’s distress of the distressful aspects of this world, Allah will rescue him from a difficulty of the difficulties of the Hereafter.” (Sahih Muslim 2699)

7. In the Path of Allah

This category encompasses individuals striving for Allah’s cause, such as those engaged in humanitarian efforts or defending their communities. Supporting them through Zakat enables them to continue their noble work.

8. Wayfarers (Travelers)

Travelers stranded or facing financial difficulties far from home also qualify for Zakat. This includes refugees seeking safety and opportunities in unfamiliar lands.

“…and for the wayfarer (a traveler who is cut off from everything)…” (Al-Quran 9:60)

Types of Zakat

There are two primary forms of Zakat in Islam. Each serves a distinct purpose in promoting economic justice and fostering societal welfare.

1. Zakat al-Mal (Wealth Zakat)

Zakat al-Mal is a mandatory annual payment based on an individual’s accumulated wealth. It applies to specific categories of assets, such as:

- Cash and Savings: Money stored in bank accounts or as cash-on-hand.

- Gold and Silver: Precious metals held as jewelry or investments.

- Business Assets: Goods and inventory intended for trade.

- Agricultural Produce: Crops and harvests exceeding a specific threshold (nisab).

- Livestock: Animals such as camels, cows, and sheep, depending on quantity and grazing conditions.

The standard rate for Zakat al-Mal is 2.5% of one’s total wealth, provided it exceeds the nisab threshold.

“Establish prayer and give Zakat, and whatever good you put forward for yourselves – you will find it with Allah.” (Al-Quran 2:110)

2. Zakat al-Fitr (Fitrana)

Zakat al-Fitr is a smaller, obligatory charity given by every Muslim at the end of Ramadan, before the Eid al-Fitr prayer. Its purpose is to:

- Purify the fasting individual from minor sins.

- Enable the less fortunate to partake in Eid celebrations.

The amount is usually equivalent to the cost of one meal and is calculated based on the local price of staple foods like wheat, rice, or dates. Every Muslim, regardless of age, must pay Zakat al-Fitr for themselves and their dependents.

“The Prophet (peace be upon him) made Zakat al-Fitr obligatory as a purification for the fasting person from idle talk and obscene words and to feed the poor.” (Sunan Abu Dawood 1609)

Why Is Transparency Important?

Transparency in zakat distribution is the backbone of trust and efficiency. Without it, the entire system risks becoming unreliable and ineffective. 📊

Accountability Matters

When donors know exactly where their contributions are going, they’re more likely to trust the process. This accountability ensures that the recipients of zakat truly benefit from the funds.

Building Trust in Institutions

Organizations that maintain transparency often gain the trust of the public. Sharing detailed reports about how funds are used fosters a sense of reliability among donors. Imagine donating to an institution that provides clear, timely updates—doesn’t that make you want to give more?

Efficient Use of Resources

Transparency also ensures resources are allocated efficiently. Mismanagement and misuse can be identified and rectified promptly. This guarantees that every penny goes to those in need.

How to Ensure Transparency

- Regular Audits: Conduct audits to track fund usage.

- Open Communication: Keep donors informed through newsletters and reports.

- Use Technology: Employ platforms that allow real-time tracking of donations.

Empowering the Donors

Transparency empowers donors to make informed decisions about their contributions. When they know their money is making a real difference, it encourages a culture of continuous giving. 🌟

Highlighting Positive Impact

Transparent processes also highlight success stories. For instance, showcasing how a zakat contribution helped a needy family or supported a revert to Islam can inspire others to contribute. Visual evidence, like photos or videos, amplifies this effect and reinforces donor confidence.

In essence, transparency is not just a nice-to-have—it’s a necessity that upholds the integrity of zakat as a spiritual and social obligation. When organizations and individuals prioritize openness, the ripple effect benefits everyone involved, from the donor to the ultimate recipient. Let’s strive for a system where transparency becomes the gold standard for zakat distribution. 🌟

The Significance of Zakat in Modern Times

In today’s interconnected world, Zakat plays a crucial role in alleviating poverty and fostering unity. Through well-organized platforms and digital tools, Muslims can easily fulfill their obligations while ensuring their contributions make a meaningful impact.

Empowering Communities

Zakat helps create sustainable solutions by funding education, healthcare, and vocational training for underprivileged communities. By focusing on long-term improvements, it uplifts entire societies.

Addressing Global Crises

From refugee aid to disaster relief, Zakat contributions address urgent humanitarian needs worldwide. Organizations leverage these funds to provide food, shelter, and medical assistance in crisis zones.

Example: During the COVID-19 pandemic, Zakat funds supported millions of families with essential supplies and financial aid.

How to Maximize the Impact of Your Zakat

To ensure your Zakat reaches those in dire need, follow these best practices:

- Research Recipients: Understand the specific needs of each category.

- Partner with Transparent Organizations: Collaborate with entities that maintain accountability and transparency.

- Leverage Technology: Use online calculators and donation platforms for ease and accuracy.

- Set Intentions: Remember, Zakat is an act of worship. Approach it with sincerity.

“Whoever gives charity equal to a date from good earnings – for Allah does not accept anything but that which is good – Allah will take it in His right hand and nurture it for him, as one of you nurtures his foal, until it becomes like a mountain.” (Sahih al-Bukhari 1410)

By following these steps, you contribute to a just, equitable, and compassionate society.

Conclusion

Zakat is much more than a financial obligation; it’s a lifeline for the less fortunate and a bridge to a more equitable society. By understanding the eight heads of zakat, Muslims can ensure their contributions make a meaningful impact. From helping the poor and needy to supporting new Muslims and freeing captives, zakat transforms lives. As we fulfill this sacred duty, let’s remember the profound wisdom behind it: creating a compassionate world where everyone thrives. Begin your journey of giving today, and witness the change it brings — not only to others but to your own life as well.

Frequently Asked Questions About Zakat

No, zakat is intended only for Muslims who fall under the eight eligible categories mentioned in the Quran. However, other forms of charity (sadaqah) can be given to non-Muslims.

No, zakat can be paid at any time of the year. However, many choose Ramadan due to its spiritual significance and multiplied rewards.

No, zakat cannot be used for mosque construction. It is specifically for helping individuals in need as outlined in the eight categories.

Nisab is the minimum amount of wealth a Muslim must possess before zakat becomes obligatory. It is equivalent to the value of 87.48 grams of gold or 612.36 grams of silver.

To ensure your zakat reaches deserving recipients, donate through reputable organizations and verify their transparency and processes.

1 thought on “Who is eligible to receive Zakat: Heads of Zakat and Their Significance in Islam”