When it comes to Islamic financial obligations, two terms that often come up are zakat and ushr. These concepts are essential in Islam, and while both aim to promote charity and assist those in need, there are important differences between them. Understanding these differences is crucial for Muslims looking to fulfill their religious duties properly. So, let’s break it down in a way that is easy to understand.

Introduction to Zakat and Ushr: A Brief Overview

Before diving into the difference between zakat and ushr, let’s first define each term.

Zakat is one of the five pillars of Islam. It is an obligatory act of charity that requires Muslims to give a certain percentage of their wealth to those in need. The goal of zakat is to purify one’s wealth and help reduce poverty.

Ushr, on the other hand, refers to a tax or levy on agricultural produce. It is a form of charity that is specific to farmers and individuals involved in agriculture. The term “ushr” literally means “tithe,” and it is typically a 10% tax on crops and produce.

Though both zakat and ushr are forms of charity, they serve different purposes and apply to different situations. Ultimzate guide on What is Zakat.

Zakat: The Pillar of Charity in Islam

Zakat is an essential part of a Muslim’s financial obligations. It is considered one of the five pillars of Islam, and fulfilling this duty is not just an act of charity; it’s a way to purify one’s wealth.

What is Zakat?

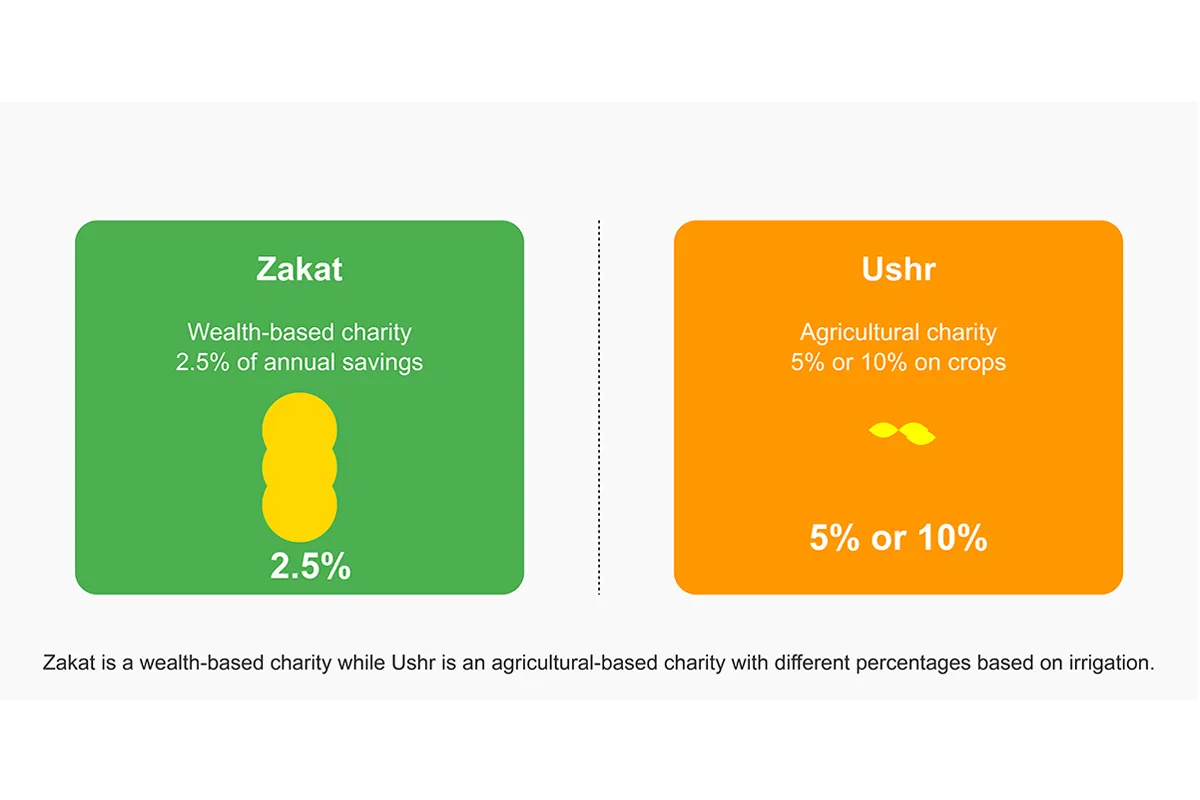

In Islamic terms, zakat is a specific amount of wealth that a Muslim must give to the poor and needy. Typically, this amount is 2.5% of a person’s accumulated wealth over the course of a year. The wealth that qualifies for zakat includes savings, gold, silver, and other assets. It doesn’t apply to personal items, such as clothing or a house you live in.

Who Needs to Pay Zakat?

Zakat is compulsory for every Muslim who meets the minimum wealth requirement, known as the nisab. This amount varies depending on the value of gold and silver. If a Muslim has the equivalent of nisab or more in their possession, they are obligated to give zakat.

Ushr: The Agricultural Levy

While zakat is about purifying wealth, ushr is a tax on agricultural products. It is specifically for Muslims who engage in farming or own agricultural land.

What is Ushr?

Ushr is a 10% levy that farmers must pay on their crops, but there is an exception for those who irrigate their land using artificial means. In these cases, the tax is reduced to 5%. This means if you harvest a significant amount of crops, you need to give a portion of it to the needy. It serves as a form of charity within the agricultural sector, promoting community support and the well-being of those in need.

Who Needs to Pay Ushr?

If you’re involved in farming or own agricultural land, you are required to pay ushr. However, the amount of tax varies based on how the crops are irrigated, as mentioned before. Check out Government of Pakistan laws about zakat here.

The Key Differences Between Zakat and Ushr

Now that we know what zakat and ushr are, let’s dive deeper into the difference between zakat and ushr.

- Scope:

- Zakat applies to all Muslims who meet the nisab threshold, regardless of their profession or assets.

- Ushr, however, is specific to those who cultivate crops or engage in agricultural work.

- Rate of Contribution:

- Zakat is generally set at 2.5% of your savings and other wealth.

- Ushr is usually 10% of your crops, or 5% if artificial irrigation is used.

- Purpose:

- Both zakat and ushr aim to support the needy, but zakat purifies the wealth of individuals, while ushr specifically supports farmers and agriculture-based communities.

- Type of Wealth:

- Zakat applies to all forms of wealth, including cash, savings, and valuable assets like gold.

- Ushr applies only to agricultural produce.

The Importance of Paying Zakat and Ushr

Both zakat and ushr play a vital role in maintaining social justice in Islam. These acts of charity are designed to redistribute wealth in society, reducing inequality and helping those who are less fortunate.

- By paying zakat, you purify your wealth and fulfill a religious duty that is highly encouraged in the Quran and Hadith.

- Through ushr, you help agricultural communities thrive and ensure that those involved in farming can sustain themselves.

These practices are essential for a Muslim’s spiritual growth and financial well-being.

How Do You Calculate Zakat and Ushr?

Knowing how to calculate zakat and ushr is essential for fulfilling your duties. Let’s break it down:

Calculating Zakat:

- Step 1: Determine the total value of your wealth, including savings, investments, and other assets.

- Step 2: Check if your wealth meets the nisab threshold. If it does, you are eligible to pay zakat.

- Step 3: Calculate 2.5% of your total wealth.

- Step 4: Donate the calculated amount to the needy.

Calculating Ushr:

- Step 1: Calculate the total amount of crops or agricultural produce harvested.

- Step 2: Determine whether the crops were irrigated naturally or artificially.

- If naturally irrigated, the tax is 10%.

- If artificially irrigated, the tax is 5%.

- Step 3: Pay the appropriate percentage to charity.

Common Questions About Zakat and Ushr

1. Can Zakat Be Paid on All Types of Wealth?

Yes, zakat can be paid on any wealth you possess, such as savings, business income, and investments, as long as they meet the nisab threshold.

2. Is Ushr Only for Farmers?

Yes, ushr is only required for individuals who produce crops or are involved in agriculture.

3. Can Ushr Be Paid on Cash or Other Assets?

No, ushr is specifically related to agricultural produce. For other forms of wealth, zakat should be paid instead.

Where Can You Calculate Zakat?

To make things easier, many online platforms provide zakat calculators to help you determine the exact amount you need to pay. For a detailed calculation, check out here is the zakat calculator.

Important Information About Zakat &Ushr

| Category | Zakat | Ushr |

| Who Pays It? | Every Muslim with nisab wealth | Farmers or agriculturalists |

| Rate | 2.5% of total wealth | 10% of crops (5% if artificially irrigated) |

| Purpose | Purifying wealth, helping the needy | Supporting agricultural communities |

Final Thoughts: Understanding the Difference Between Zakat and Ushr

It’s clear that zakat and ushr are both forms of charity in Islam, but they differ significantly in scope, application, and purpose. While zakat applies to all Muslims who meet the wealth threshold, ushr is specific to agricultural produce.

By fulfilling these obligations, Muslims help reduce inequality, support the poor, and purify their wealth in accordance with Islamic teachings. Whether you’re a farmer or an individual with wealth, understanding the distinction between these two obligations ensures that you can fulfill your duties with clarity and confidence.

Now that you have a clear understanding of zakat and ushr, take the next step in fulfilling your religious obligations. Happy giving!

Frequently Asked Questions (FAQs)

The main difference between zakat and ushr is that zakat is a charity obligation for Muslims who meet a certain wealth threshold, while ushr is a levy on agricultural produce that applies specifically to farmers. Zakat is 2.5% of wealth, while ushr is typically 10% (or 5% if artificially irrigated).

Every Muslim who possesses wealth that meets or exceeds the nisab (minimum amount) is required to pay zakat. This includes savings, gold, silver, and business assets, provided they have been in possession for a full lunar year.

No, ushr is only required for individuals who are involved in farming or agriculture. If you don’t cultivate crops or own agricultural land, you are not required to pay ushr. Zakat, however, applies to all Muslims who meet the wealth threshold.

No, zakat is not required on property used for personal purposes, such as your home. However, zakat must be paid on other forms of wealth, including savings, investments, and business assets that meet the nisab threshold.

To calculate zakat, determine the total value of your wealth (savings, investments, etc.), and ensure it exceeds the nisab threshold. If it does, calculate 2.5% of the total amount, and that is the amount of zakat you must pay to charity.

Yes, many websites offer a zakat calculator that helps you easily determine how much zakat you need to pay based on your wealth. You can use online tools to ensure accurate calculations before making your donation. Here is the zakat calculator for your convenience.

1 thought on “Zakat and Ushr: Key Differences Explained”